In the first half of 2024, China's photovoltaic industry faced unprecedented challenges due to overcapacity caused intensifying competition across the entire supply chain. Prices of key products such as polysilicon, silicon wafers, solar cells, and modules plummeted significantly, posing serious risks of inventory write-downs and severely impacting corporate operations. As a result, most photovoltaic enterprises saw substantial declines in performance, with many slipping into losses.

Since early July, several leading photovoltaic companies, including GCL System Integration (GCL SI), have disclosed their performance forecasts for the first half of the year. Surprisingly, GCL SI achieved earnings growth and net profitability rarely seen among them. According to its announcement, GCL SI expects first-half revenues to range from USD1.07 billion to USD1.17 billion, marking a year-on-year increase of 39.15% to 51.64%. Despite challenges in the second quarter, the company still anticipates profits between USD5.51 million and USD7.17 million.

In comparison with its competitors, GCL SI leads the industry in operational performance growth rate, advanced capacity ratio, lean manufacturing efficiency, and market share. How has GCL SI managed to navigate through the industry's downturn?

According to GCL SI, the company significantly strengthened sales force and marketing this year, overcame internal and external pressures and secured more sales orders in the domestic market. Statistics show that since this January GCL SI has secured bids or been shortlisted for procurement projects from major entities such as China Resources Power, CNNC, China Datang, Sinohydro, China Huaneng, China Huadian, Green Power, and etc., with intended sales scales exceeding 50GW. Continuous orders ensured that GCL SI maintains a leading position in the utilization rates of its own cell and module production lines within the industry.

Additionally, GCL SI has intensified its cost reduction and profit enhancement strategies. By optimizing internal operations, the company has lowered non-silicon costs of its self-produced solar cell and PV modules. It has also improved financing structure to reduce capital cost and increase turnover rate. Furthermore, through breakthroughs in system integration services, GCL SI has significantly expanded the scale of EPC grid connection and testing, thereby boosting revenue and profits. The company indicates that all financial indicators are healthy and continually improving.

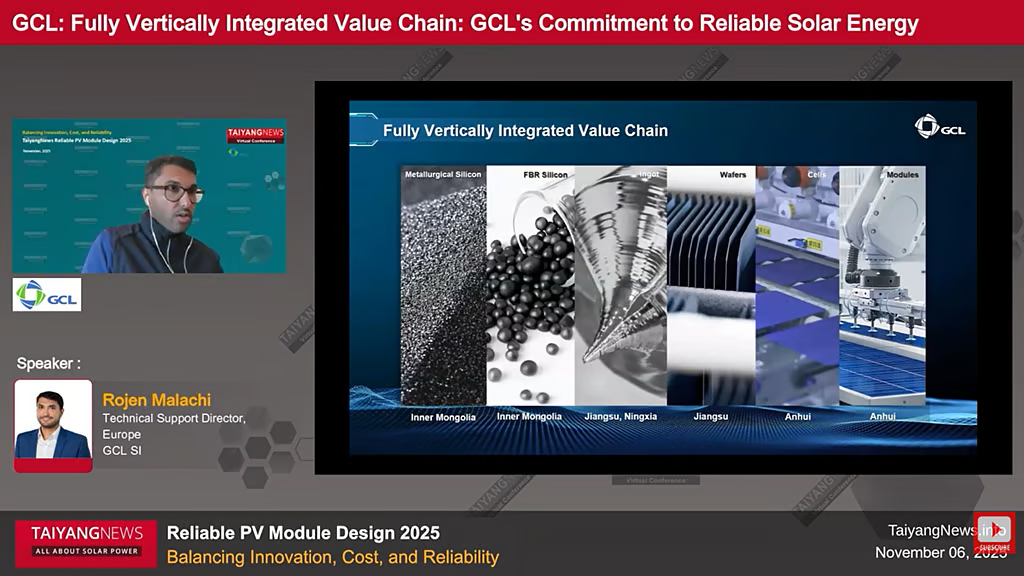

Moreover, the absence of outdated production capacity has greatly aided GCL SI in achieving excellent performance. During the previous industry cycle, GCL SI discarded all outdated production capacity, allowing it to move forward unburdened. Since 2023, GCL SI has focused on N-type TOPCon technology, initiating the construction of cell and module capacity. Currently, GCL SI possesses a total of 12 GW of N-type TOPCon cell capacity and 30 GW of module capacity.

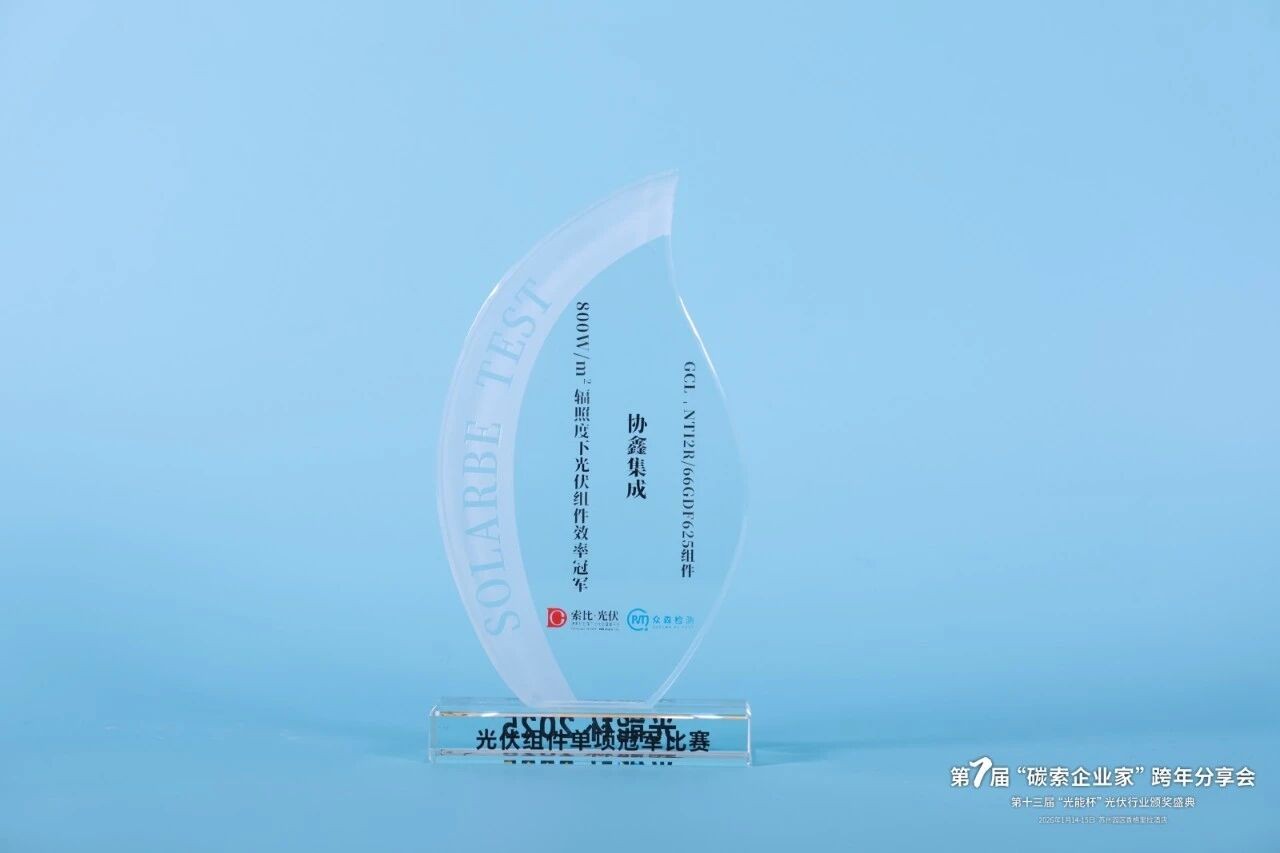

In terms of research and development, GCL SI has consistently pursued advanced technologies. Following significant achievements in N-type TOPCon cell technology, with production efficiency exceeding 26.2%, GCL SI has obtained power certifications of 625W and 710W for 182mm and 210mm TOPCon modules, respectively. Looking ahead, GCL SI is advancing in the development of next-generation Back-Contact (BC) cell technology, with plans for mass production expected by the fourth quarter of 2024.

Speaking at the 2024 SNEC Shanghai PV Expo, Zhu Gongshan, Chairman of GCL Group, stated, "Despite the current severe industry supply-demand mismatch and the onset of an ice age... Every market shock gradually nurtures significant industrial changes... Current demand for photovoltaics will remain at high growth levels, thus we must maintain confidence in crossing the cycle."

As a veteran in the photovoltaic industry, GCL SI has successfully navigated multiple industry cycles. Leveraging forward-looking strategic deployments and robust operations to once again traverse the industry cycle steadily, GCL SI will continue providing customers with long-term, reliable products and services.