Europe’s sustainability framework is driving a structural shift in how carbon is treated in business. What was once a voluntary ESG metric is rapidly becoming a contractual, disclosure, and due-diligence requirement. Under regulations such as the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD), the first change is not a cost, but a question:

Can the environmental impacts of products and supply chains be documented, explained, and audited with confidence?

CSRD significantly expands the scope, depth, and assurance requirements of sustainability reporting, requiring companies to disclose climate risks, emissions, and transition plans using standardized, decision-useful data. CSDDD complements this by placing clear expectations on companies to identify, prevent, and mitigate adverse environmental impacts across their value chains. Together, these regulations signal a clear direction: Europe is building a market where carbon evidence increasingly sits alongside price, performance, and bankability.

What this means for the solar sector

For solar, the impact is indirect but material. While PV modules themselves are not regulated as a separate product category, solar supply chains are deeply interconnected with energy use, upstream materials, and manufacturing emissions. Under CSRD and CSDDD, developers, EPCs, and investors are required to understand and explain these impacts- not just at corporate level, but across projects and suppliers.

As a result, solar supply chains are being asked to adopt a new operating language: traceable emissions, clearly defined boundaries, and finance-grade documentation. What once sat in sustainability reports is now moving into procurement decisions, risk assessments, and financing discussions.

Short term: from ESG narrative to documentation test

In the near term, CSRD is already reshaping procurement behaviour. Buyers are increasingly requesting product carbon footprints, transparent methodologies, and auditable supporting evidence during tenders and due-diligence processes. Uncertainty has become a hidden risk: where emissions data cannot be produced reliably, buyers and financiers may assume conservative positions, complicating pricing, approvals, and timelines. The challenge is not only cost- it is predictability, and project finance does not tolerate ambiguity.

Medium term: carbon data becomes finance-relevant

As CSRD disclosures mature and CSDDD comes into force, carbon documentation is increasingly treated as part of a project’s risk profile. Lenders, insurers, and institutional investors are learning to assess emissions data with the same scrutiny applied to warranties, certifications, and supply-chain resilience. The regulatory message is clear: data must be comparable, auditable, and methodologically robust. For buyers, this is not a one-off exercise, but a need to build repeatable, scalable processes across projects and suppliers.

Long term: lifecycle value over sticker price

Beyond compliance, these regulations reinforce a longer-term shift in Europe’s solar market-from upfront module price to lifecycle value and lifecycle carbon. Modules that last longer, degrade more slowly, and perform reliably reduce replacement needs, increase lifetime generation, and lower emissions per kilowatt-hour delivered. Reliability becomes, quietly, a climate metric. Procurement becomes strategic, asking not just “what does it cost today?” but “how defensible is this supply chain over 25 years?”

What European buyers should ask- and why it matters

In a CSRD and CSDDD environment, disciplined early questions increasingly pay off:

Can suppliers provide carbon and environmental data with clear boundaries and assumptions? Are upstream materials supported by traceable sourcing and credible emissions factors? Are third-party verifications, EPDs, or equivalent documents available for auditors, lenders, and compliance teams? And do reliability metrics and warranty structures meaningfully reduce lifecycle risk- and therefore lifecycle emissions per kilowatt-hour? Asked early, these questions do not slow procurement; they make it more resilient.

How suppliers are adapting as carbon becomes part of procurement

EU sustainability regulation raises the cost of uncertainty for buyers. Incomplete emissions data, limited supply-chain visibility, and weak documentation increasingly translate into commercial and financing risk. In response, leading suppliers are moving beyond disclosure toward embedding carbon readiness into their operating models.

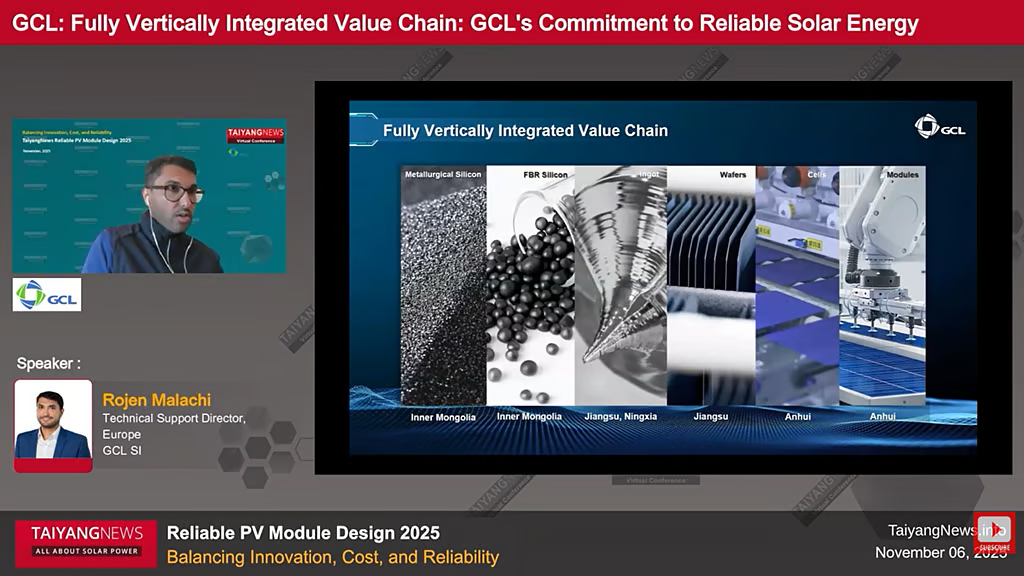

GCL SI is among those positioning to meet this shift directly. By integrating carbon management into materials, systems, and governance, the company is working to ensure that environmental data is delivered as a standard component of procurement- not an afterthought.

At the source, emissions are targeted where they are most concentrated in the PV value chain: silicon feedstock. The deployment of FBR-based granular silicon, a lower-energy production pathway, reduces baseline material emissions and improves stability and defensibility in downstream accounting.

At the system level, GCL’s Carbon Data Platform supports governed carbon monitoring across the PV value chain. As it has evolved from Carbon Chain 1.0 to 3.0, the platform has expanded from footprint disclosure to batch traceability, operational monitoring, and an open architecture aligned with international methodologies and supported by third-party verification. Emissions data-from polysilicon and wafers to cells and modules- are captured in a common, audit-ready framework suitable for procurement, due diligence, and project finance.

Because regulatory credibility rests on the full value chain, upstream partners are integrated into the same governed reporting environment through standardized templates, data-quality controls, and participation rules. This reduces the risk that upstream gaps undermine disclosures across shipments or project portfolios.

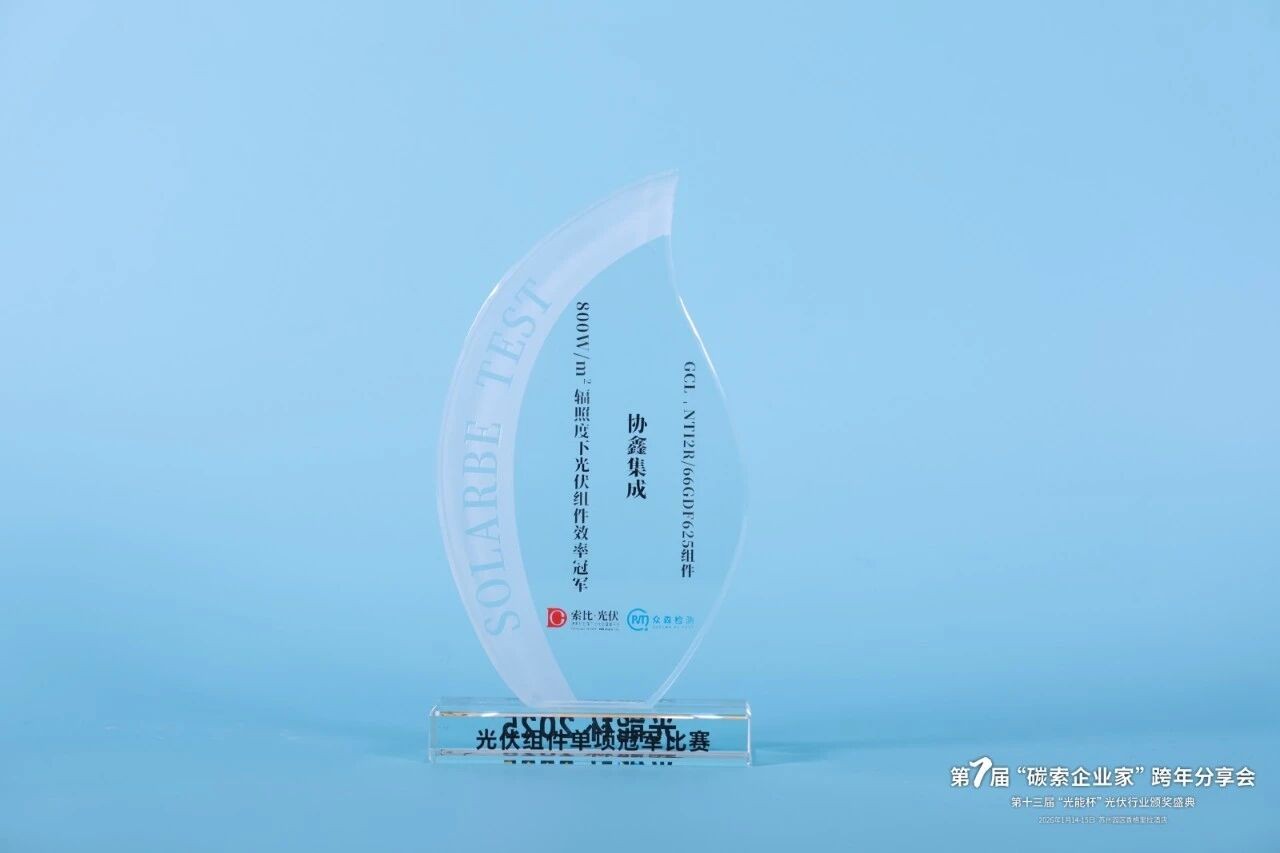

At product level, transparency becomes usable. Within the SiRo module series, built around a Silicon-to-Zero philosophy, selected low-carbon products apply a “one module, one code” mechanism that anchors environmental data to individual modules- supporting audits, customer reviews, and financing assessments.

Taken together, this approach helps European buyers procure regulation-ready assets: lower emissions at the source, governed data across the supply chain, supplier transparency, and product-level traceability that stands up to scrutiny- making sustainability compliance a predictable part of procurement rather than a late-stage risk.

Source: PV Magazine